Part 1

The financial heartbeat of Europe is set for a significant shift as SEPA Instant Payments carve a path toward a real-time economic landscape. Many consider payments the lifeblood of the economy, necessitating the free and fast flow of money. SEPA Instant Payments will usher in a new era of immediacy that integrates the latest technological advancements to meet the modern market’s pulse.

This is the first part of a two-part series highlighting key takeaways from our recent webinar, “SEPA instant payments: Are banks ready?” It includes an overview of the regulatory mandate, how instant payments are defined, and the challenges and impacts among banks and payment service providers.

Mandate and first-mover advantage

At the core of SEPA Instant Payments’ growing influence is a regulatory mandate that serves as both a directive and a beacon for the future of financial transactions. This mandate is slated for implementation by 2025 for participants within the euro currency zone and by 2027 for those outside it.

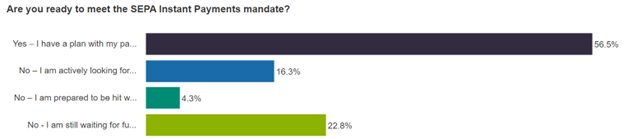

While instant payments have been a part of the European financial fabric for some time, adoption has not been as widespread as many had hoped. The new regulation will drive adoption, though results from our webinar poll suggest many PSPs are battling stagnation. Just under half of the respondents (43.4%) reported that they don’t currently have a solution or provider to help them meet the mandate.

The regulatory impetus is clear—service providers must not only prepare to meet the deadlines but also capitalize on the first-mover advantage. The early adoption of SEPA Instant Payments is expected to yield a competitive edge, and the framework sets the stage for an increasing array of applications and business models. In many ways, the regulation will act as a catalyst, accelerating innovation that can add significant value to businesses and consumers alike. The challenge is understanding the requirements of the regulation and employing the right infrastructure and tools to meet them.

Understanding SEPA Instant Payments requirements

Much of the conversation regarding SEPA Instant Payments has centered around redefining what “instant” means. The approved regulation’s text stipulates that money must arrive in the recipient’s account within ten seconds. If a positive confirmation from the counterparty is not received within the designated seconds, the payment must be deemed unsuccessful.

Additionally, these instant credit transfers must be made available 24/7/365, allowing users to send money at any time. These specifications are not trivial and have far-reaching implications for how payments are processed, requiring robust backend systems capable of nearly instantaneous communication and confirmation.

The new regulation also requires that every payment service provider (PSP) offering classic SEPA credit transfers must also support instant transfers, both sending and receiving. This requirement ensures uniformity and universal access, fostering a more inclusive financial environment. The regulation also addresses the need for synchronized pricing between classic and instant SEPA payments and mandates that banks provide upfront verification of the payee. An update on how sanctions screenings are conducted is also a component of this reform.

Lastly, the regulation grants payment and e-money institutions (PIEMIs) that are not traditionally considered banks the opportunity to access payment systems. Subsequently, they will be held to the same obligation to enable instant credit transfers after the transition period. This democratization of access is a significant step towards leveling the playing field. It will offer a broader spectrum of financial players the chance to innovate within the SEPA Instant Payments framework.

Challenges for payment service providers (PSPs) and financial institutions (FIs)

Payment service providers (PSPs) and financial institutions (FIs) face a spectrum of challenges in the transition to SEPA Instant Payments. These challenges vary in complexity and scale, depending on each entity’s current infrastructure – and to what degree it can readily adapt to a system that demands real-time processing capabilities. For those PSPs and FIs still operating without the necessary infrastructure, the shift represents a paradigm change and will require a complete technological overhaul rather than an upgrade of existing systems.

Many will grapple with legacy platforms that were not originally designed for the immediacy that instant payments demand. These providers will also need to consider the need for advanced fraud detection mechanisms and sanctions screening processes that align with the rapid cadence of instant transactions.

In this way, the move towards SEPA Instant Payments isn’t just a technological challenge but a strategic one too. PSPs must navigate the transition while balancing regulatory demands with the need to maintain liquidity, ensure seamless settlement and reconciliation processes, and manage potential operational disruptions. As a result, many PSPs and FIs are exploring alternative solutions, including cloud services and payment-as-a-service models, which promise quicker implementation timelines and a shift from capital expenditures to operational ones.

One perspective is to look at this regulation as a helpful nudge in the direction of modernization that is sorely needed already. Embracing the shift not only enables providers to be compliant but also to make a technological play that offers a better strategic position.

Current focus and future impacts

PSPs and FIs are finding themselves in the eye of the storm as the SEPA Instant Payments mandate approaches. Even institutions already connected to instant payment systems still have work to do to prepare for the upcoming regulatory changes. This work is even more substantial for those yet to offer instant payment services.

In the near term, many PSPs and FIs will focus on project execution. The coming eight to 12 months are critical, with most efforts focused on building the necessary infrastructure to handle incoming transactions. This includes adapting to the new sanctions functionalities and other aspects of the regulation designed to smooth out potential points of friction, such as verification of payee and pricing requirements.

Ultimately, the successful adoption of SEPA Instant Payments is expected to reshape the relationship between corporates and banks. The future might see a gradual movement of volume from standard credit transfers to instant payments, igniting the development of innovative products and services that leverage the instant payments infrastructure, ensuring a robust, efficient, and more economically integrated Europe.

SEPA Instant Payments is positioned to be the foundation of the future of European financial services. The migration to instant payments isn’t merely a regulatory hurdle to clear; it is a transformative stride towards a future where transactions are as seamless as they are swift.