Mid-tier financial institutions (FIs) face the exciting challenge of staying ahead in the rapidly changing world of payments, especially as real-time payments take hold. In its latest research, Volante surveyed 72 mid-tier banks across the U.S., revealing a 50% increase in the number of FIs that plan to connect to FedNow® this year, among other insights.

The results also uncovered some enlightening trends that illustrate how FIs are navigating the swift currents of payments modernization. In part one of this two-part blog series, we’ll explore the push toward real-time/instant payments, the impact of FedNow®, conversion to ISO 20022, and more. There’s a lot to dissect.

The rise of instant payments and FedNow®

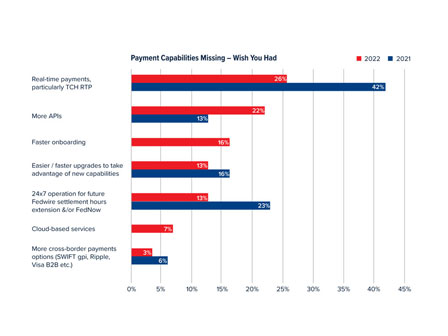

The buzz around instant payments is not new; FIs report that real-time payments is the number one requested capability among corporate clients. Thirty-two percent of mid-tier banks say instant payments are what corporate clients are asking for most, followed by faster connectivity to ERP systems (20%). Subsequently, nearly half (47%) of institutions in the process of acquiring an instant payments system are in the discovery and planning stage and 42% have selected a vendor.

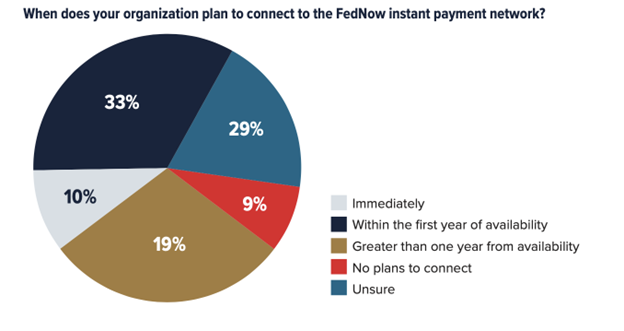

It’s no surprise that instant payments have caught the eye of many given the launch of the FedNow service in July. Survey results indicate that 43% of mid-tier banks have expressed their intention to connect to the service within the year – a significant jump from the previous year’s 29%.

This growing certainty in adopting FedNow® demonstrates a sense of urgency now that the service is live. It also signals what will likely be the expansion of instant payments in the U.S. and the subsequent payments modernization for many players in the payments space.

ISO 20022 – the new messaging standard

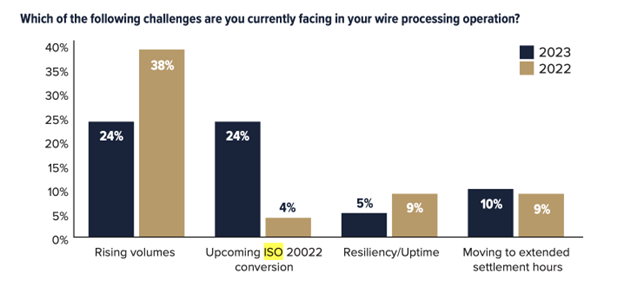

The survey revealed a growing concern among FIs regarding the conversion to ISO 20022, with mentions spiking from 4% last year to 24% this year. This shift is no doubt influenced by the Federal Reserve’s decision to adopt this messaging standard for FedNow and the impending migration of FedWire by 2025. The swifter these institutions adapt to this standard, the better poised they are to serve their customers seamlessly.

Rising wire volume is still top of mind for mid-tier banks, with 24% saying it presents a challenge in wire processing operations in 2023, though this is down from 38% who said it was a challenge last year.

Despite these challenges, migration to and compliance with ISO 20022 offers a shared framework for financial communication – and the foundation for innovative financial products and services. Banks that can shift from a compliance-centric perspective to a strategic one may fare better when it comes to differentiation and offering value-added services to customers.

Navigating the future

These insights underline a clear theme: mid-tier banks are recognizing the significance of instant payments, ISO 20022, and the potential of PaaS in redefining their payment capabilities. As the financial industry continues its rapid digital transformation, embracing these trends will be vital for institutions that want to lead the market.

Operating as a trusted partner for customers remains paramount for financial institutions. Understanding – and quickly adapting to – the evolving needs of the industry fosters trust and builds credibility, ensuring that institutions not only keep pace but also set the trend.

For those hungry for more insights on the state of payments modernization in the US, download the full survey report here.